A sneak peek into biggest M&A deals in India's ecomm, Internet segments

A PHP Error was encountered

Severity: Warning

Message: file_get_contents(https://uat.techcircle.in/static_files/pe-top-investment-banks-article.html): failed to open stream: HTTP request failed! HTTP/1.1 403 Forbidden

Filename: views/article.php

Line Number: 332

Backtrace:

File: /data/httpd_data/www.techcircle.in/htdocs/web/application/views/article.php

Line: 332

Function: file_get_contents

File: /data/httpd_data/www.techcircle.in/htdocs/web/application/controllers/Article.php

Line: 204

Function: view

File: /data/httpd_data/www.techcircle.in/htdocs/web/index.php

Line: 256

Function: require_once

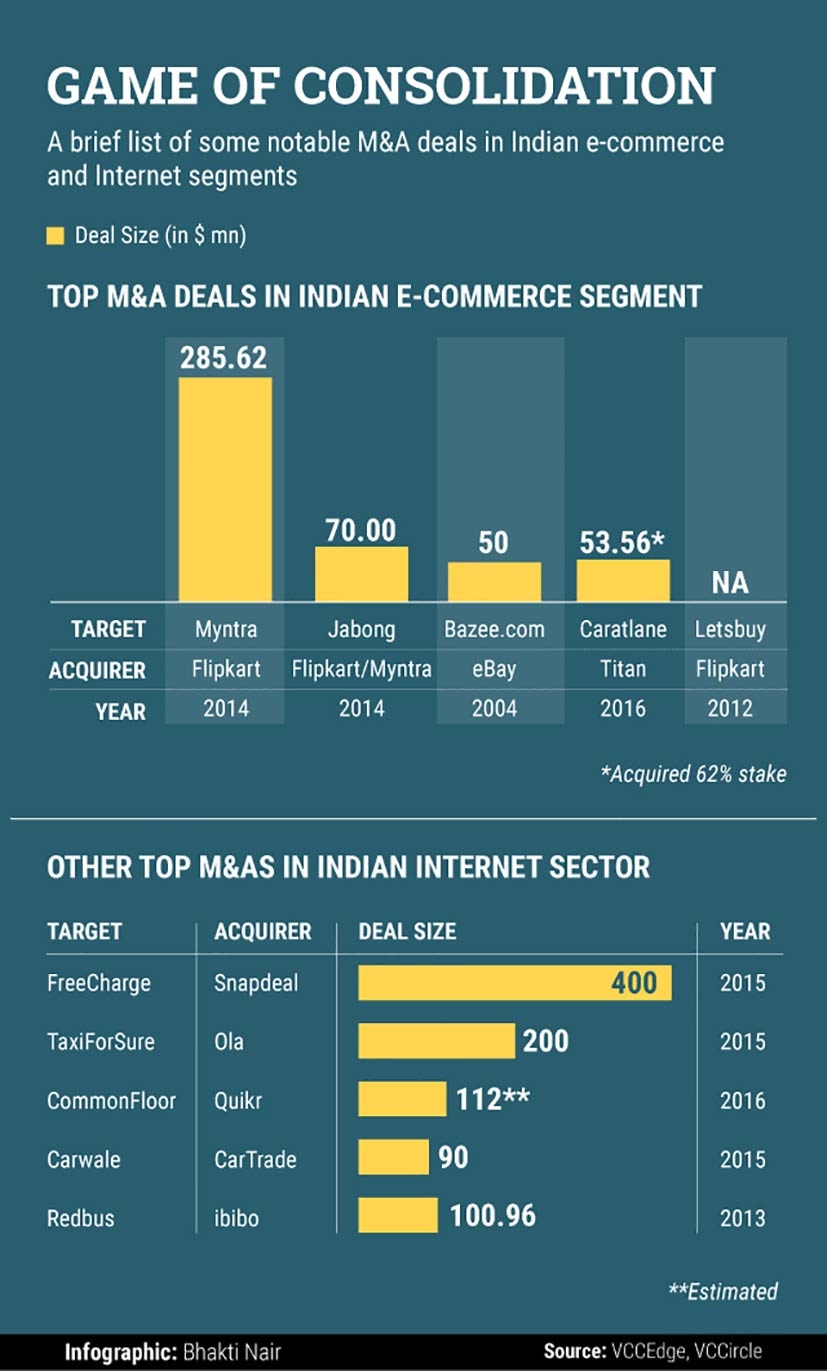

As investors turn their focus on unit economics and profitability, funding for tech startups and consumer Internet companies has tightened. This has not only resulted in a number of shutdowns in the segment but has also pushed companies to strike merger and acquisition deals.

Fashion e-commerce aggregator Voonik, for instance, acquired three startups in June 2016 alone. And there is little doubt that the sector will see more M&A deals in coming months and years.

On Thursday, VCCircle reported that Snapdeal, India's second-largest homegrown online retailer, had sent feelers to staunch rivals Flipkart and Amazon to explore a possible merger. Separately, The Economic Times said that Chinese e-commerce major Alibaba Group had held talks to acquire shopping marketplace ShopClues.

As the two news reports indicated, India's e-commerce sector could be heading toward major consolidation. For now, take a look at some of the biggest deals that have happened in India's e-commerce and the broader Internet segment.

Like this report? Sign up for our daily newsletter to get our top reports.